XRP Price Prediction December 2025: SoFi Stablecoin Launch Changes Market Focus, DeepSnitch AI Up 92%

XRP price prediction models strengthen as SoFi rolls out a bank-issued US dollar stablecoin. DeepSnitch AI gains attention as adoption trends evolve.

SoFi has launched SoFiUSD, a fully reserved US dollar stablecoin issued directly by its banking subsidiary, SoFi Bank. The token is backed one-to-one by cash and is designed for payment and settlement use across banks, fintechs, and enterprise platforms.

Bank-issued stablecoins tend to change market narratives quickly, especially across payment-focused assets and settlement infrastructure. This creates moments where information asymmetry matters, particularly for retail traders.

DeepSnitch AI addresses this gap through the real-time market intelligence tools it is currently developing. The presale has gained rapid momentum, passing the $829K mark, while the token price is up 92%.

SoFi’s stablecoin rollout reflects steady institutional adoption

SoFi’s approach reflects a broader change among US financial institutions toward incremental, compliant blockchain integration. SoFiUSD is issued by a regulated bank subsidiary and is redeemable on demand, which reinforces trust in its design.

The rollout marks a notable step for regulated institutions entering on-chain settlement. SoFi confirmed that SoFiUSD is live for internal settlement and will initially operate on Ethereum, with support for additional blockchains planned over time.

DeepSnitch AI is well-positioned to attract attention during this transition. The platform focuses on market awareness and not raw speculation. This aligns with a market that increasingly reacts to institutional news and regulatory clarity. Analysts point to its utility as a potential differentiator, which is why some model upside of up to 250x.

3 tokens to boom in 2026

1. DeepSnitch AI: Analysts see 250x possibilities

DeepSnitch AI’s tools aim to help traders observe how sentiment, activity, and attention change when institutional news impacts major assets such as XRP and Ethereum. Traders increasingly need context as stablecoins move deeper into regulated finance.

DeepSnitch AI’s relevance comes from helping users interpret these changes early, even as the full feature rollout is scheduled to occur after the presale concludes. Few presale projects offer comparable trader-facing utility at this stage. Three snitches are now live, and early holders can access the test phase to see how some of the features work.

The current pricing is at a point where asymmetric upside still exists. Reviewing the latest XRP price prediction can help when building a balanced portfolio. However, XRP is unlikely to deliver 250x returns at its current market size. DeepSnitch AI, in contrast, has a high ceiling, which means exponential gains are possible.

Anyone thinking of investing can get a 50% bonus when they spend $2,000+ with the DSNTVIP50 code. Sums of at least $5,000 will unlock a 100% boost with the DSNTVIP100 code. Rumors of possible Tier-1 and Tier-2 listings are only adding to the DeepSnitch AI hype.

2. XRP price prediction: Analysts see a path to $5

The XRP price prediction is closely linked to renewed interest in blockchain-based payments and settlement. Bank-issued stablecoins highlight the same problem XRP addresses, which is efficient value transfer across institutions and borders.

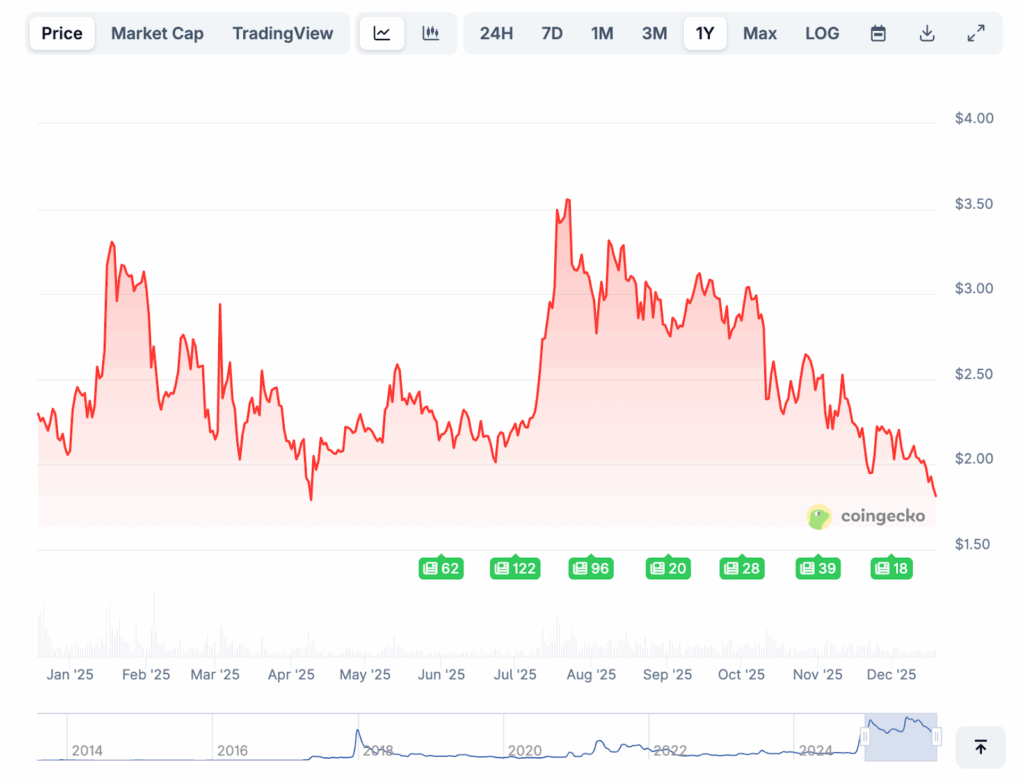

XRP technical analysis shows the token remains within a long-term accumulation structure. A realistic scenario places the XRP market forecast in the $2.50 to $3 range if institutional adoption continues to increase in 2026:

A more favorable regulatory environment could make a XRP price prediction move toward $5 plausible. This would likely require sustained transaction growth rather than speculative inflows alone.

The biggest of the XRP price drivers remains real-world payment usage and not retail momentum cycles.

3. Ethereum: A key part of any balanced portfolio

Ethereum plays a key part in enabling bank-issued stablecoins, which is why it’s trending after the SoFi news. Conservative forecasts have Ethereum getting close to $4K if network usage grows steadily and institutional settlement activity expands.

Stronger adoption where stablecoins and tokenized assets scale meaningfully could lead to a return to the $4,500 to $5,200 zone in the medium term. ETH traders are currently bullish as ETH continues to defend key support levels.

Final verdict: Institutions showing true interest

SoFi’s stablecoin launch highlights increasing utility-driven blockchain adoption. XRP price prediction models receive a healthy boost after the news.

DeepSnitch AI stands out by offering live components during its presale phase and maintaining a strong trader-focused approach. Momentum remains strong as the presale approaches the $1M milestone. Analysts see it as one of the best crypto investments to watch heading into 2026.

Join the DeepSnitch AI presale before the next scheduled price increase. Follow the project’s X and Telegram channels for the latest updates.

FAQs

Does DeepSnitch AI interact with SoFiUSD?

No. DeepSnitch AI does not interact with SoFiUSD or execute transactions. Its role is to provide intel that, so far, only whales have had access to.

How does DeepSnitch AI differ from other AI crypto projects in this news cycle?

Many AI crypto projects focus on infrastructure or abstract computing frameworks. DeepSnitch AI instead targets trader-facing utility, aiming to make market interpretation more accessible.

What stage is DeepSnitch AI currently in?

Presale participants access a test version with a live dashboard and three active AI snitches. Full feature rollout is planned after the presale ends.