XRP Price Prediction December 2025: ETF Demand Stimulates Positivity, as DeepSnitch AI Surges 92%

XRP price prediction narratives strengthen as XRP ETFs surpass $1B in assets under management. DeepSnitch AI closes in on $1M milestone.

XRP ETFs have surpassed $1B in assets under management, driven by the token’s long-standing familiarity among traditional investors and its strong multi-year performance. Executives point to XRP’s brand recognition, deep liquidity, and simple exposure as key reasons behind the steady ETF inflows. This comes at a time when other crypto ETFs struggle to hold demand.

The milestone has pulled XRP price prediction models back into focus as capital increasingly rotates toward regulated crypto exposure.

DeepSnitch AI enters this discussion as traders seek tools to interpret where attention and liquidity move during ETF-driven market changes.

Momentum continues to build as the presale moves toward the $1M mark. Visible development progress and ongoing listing speculation are keeping DeepSnitch AI firmly on trader watchlists going into 2026.

Institutional demand changes XRP narratives

Executives point to familiarity as a key driver behind XRP’s ETF success. XRP’s long track record and recognizable use case have made it easier for traditional investors to gain exposure, which has accelerated XRP institutional adoption within regulated investment products.

XRP’s performance over the past three to four years has also played a role in changing sentiment. Spot XRP ETFs have now recorded hundreds of millions in net inflows, placing XRP among the most successful altcoin ETF launches to date.

DeepSnitch AI becomes relevant in this environment because ETF inflows often trigger uneven reactions across tokens and narratives. Analysts are impressed by the utility so far, which is why they’ve given DeepSnitch AI a chance of a 100x return.

DeepSnitch AI: Offering big asymmetric upside

DeepSnitch AI is an early-stage project that is already showing tangible trader-facing utility. Many presales spend months promoting roadmaps without delivering visible products. The DeepSnitch AI dev team regularly provides updates so users can see how they are progressing. This transparency is rare in the current presale environment.

The two security audits add even further credibility. Investors feel more confident about putting their money into an early-stage project when it can show this level of credibility. The key advantage DeepSnitch AI offers over XRP price prediction narratives is asymmetric upside.

You won’t ever get 100x returns with XRP due to its $113B market cap. However, DeepSnitch AI is available for $0.0903 currently. This creates a window where smaller allocations carry disproportionate upside ahead of a public market launch.

Rumors of a Tier-1 listing add even more weight to this argument. The DeepSnitch AI team is going a step further in looking after early holders during December. Anyone who spends at least $2,000 with the code DSNTVIP50 can get a 50% boost to their allocation. DSNTVIP100 will double your tokens with a $5,000+ payment.

DeepSnitch AI’s community approach is clearly paying off. The presale is already over the $850K mark, and the momentum doesn’t look like stopping anytime soon.

Added to that are the clear use cases and the rumors of a major listing. That’s why analysts believe a 100x run could be in the future for DeepSnitch AI.

⚠️🚨 DeepSnitch AI Official Warning: Don’t Fall for Fake Websites!🚫

XRP price prediction: Quick gains appear achievable

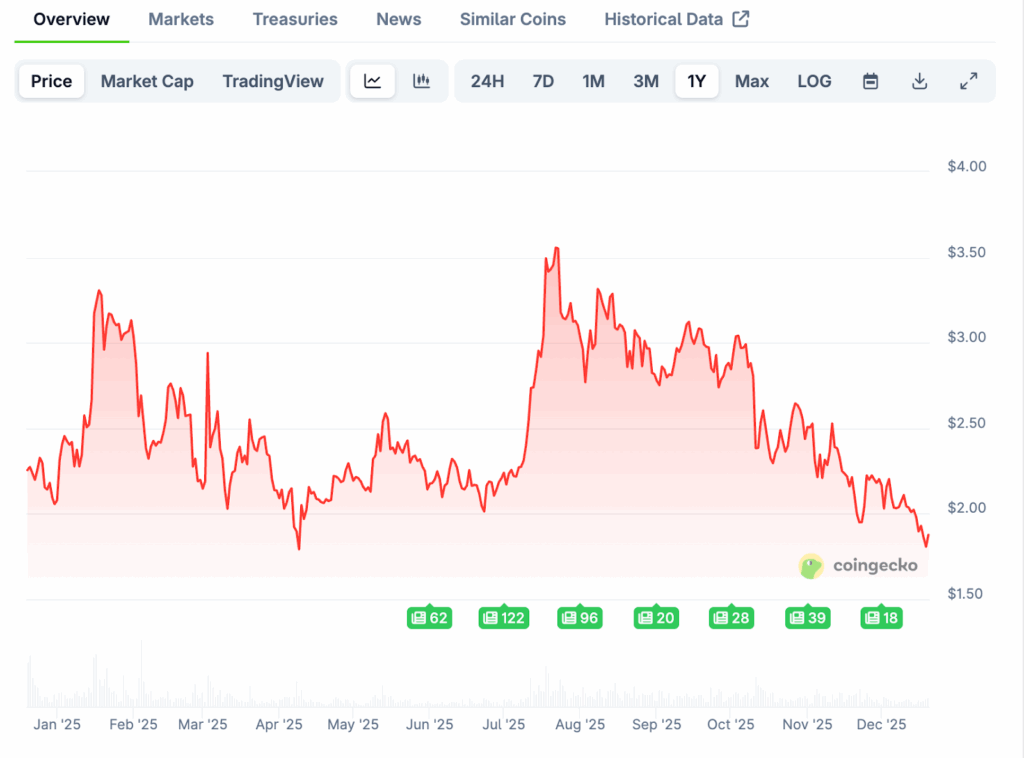

XRP continues to trade within a defined range as ETF inflows provide structural support. XRP technical analysis shows consolidation after strong multi-year gains. This type of pattern is often associated with accumulation.

Analysts see room for a return to $3.50 levels in the coming weeks if ETF inflows remain consistent and broader market conditions begin to stabilize:

Updated XRP price prediction models question if sustained ETF demand is able to offset wider market volatility. More regulatory stability and continued ETF inflows could see a run towards $4.00 by mid-2026.

The broader Ripple ecosystem outlook of ongoing development and notable cross-border payment initiatives maintains XRP’s long-term relevance.

Solana: Growing institutional interest

Solana is also seeing growing interest as traditional investors gain clarity on its application layer, fee structure, and user activity. SOL ETFs have gathered $119M in net inflows so far in December, which shows a notable uptick in institutional interest.

Coinbase CEO Brian Armstrong also publicly endorsed Solana this week, with Solana DEX trading now available on the exchange. Exchange integrations and rising institutional interest continue to strengthen Solana’s medium-term outlook. A path back to $250 is possible from the current $125 levels in the coming months.

Final verdict: Bullish signals for XRP

XRP’s ETF milestone highlights how familiarity and accessibility drive institutional flows. XRP price prediction models have adjusted quickly following the ETF milestone.

DeepSnitch AI is also getting plenty of attention as its presale continues to heat up. Then there’s the impressive utility, Tier-1 listing rumors, and meme coin energy to contend with. These factors add up to a 100x forecast from analysts.

Take part in the DeepSnitch AI presale today before the next price rise. Follow the project’s X and Telegram pages for frequent updates.

FAQs

Can beginners use DeepSnitch AI effectively?

Yes. The test dashboard and AI snitches are designed to be accessible, allowing newer traders to interpret market context without needing advanced technical knowledge.

What makes DeepSnitch AI different from other AI crypto projects?

Most AI tokens focus on infrastructure or compute resources. DeepSnitch AI instead targets trader-facing utility, aiming to make market interpretation simpler and more accessible.

Does DeepSnitch AI track ETF flows directly?

No. DeepSnitch AI does not pull ETF data or execute trades.