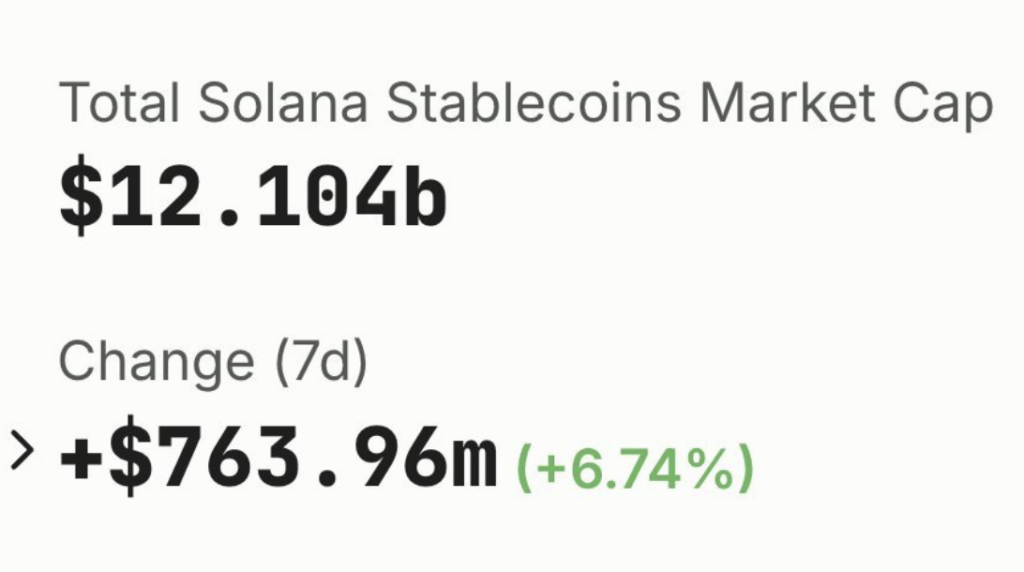

- Solana’s stablecoin market cap exceeds $12 billion.

- USDC dominates with nearly 80% market share.

- Memecoin trading significantly boosts network activity.

The Solana blockchain has achieved a significant milestone, with its stablecoin market capitalization surpassing $12 billion. This growth underscores Solana’s expanding role in the cryptocurrency ecosystem, particularly in the realm of decentralized finance (DeFi).

Rapid Growth in Stablecoin Market Cap

Starting the year with a stablecoin market cap of $5.1 billion, Solana has more than doubled this figure, reaching over $12 billion. This remarkable increase highlights the network’s rapid adoption and the escalating demand for stablecoins within its ecosystem.

Dominance of USDC on Solana

A significant contributor to this surge is Circle’s USD Coin (USDC), which accounts for nearly 80% of the stablecoin supply on Solana, amounting to approximately $9.25 billion. Tether’s USDT follows, comprising about 12% of the market share on the network.

Impact of Memecoin Trading

The launch of memecoins, notably the Official Trump (TRUMP) token, has played a pivotal role in boosting Solana’s network activity. Introduced on January 18, the TRUMP token attracted hundreds of thousands of new on-chain users, leading to record decentralized exchange trading volumes and a substantial influx of capital into the network.

Solana’s Position in the Stablecoin Landscape

With this surge, Solana has become the third-largest blockchain network by stablecoin supply, trailing only Ethereum and Tron. This ascent reflects the platform’s growing appeal, driven by its high transaction speeds and low fees, which are particularly attractive for traders and developers.

Conclusion

Solana’s achievement in surpassing a $12 billion stablecoin market cap marks a significant milestone in its development. The combination of USDC’s dominance and the influx of memecoin trading has propelled the network to new heights, solidifying its position as a key player in the DeFi space.