Solana Price Prediction 2026: ETF Delays and Market Anxiety Weigh on SOL, as DeepSnitch AI Powers Ahead With Launch Coming Up

This December, SOL breaks below Fibonacci support amid ETF delays, while the DeepSnitch AI presale offers deployed utility before January launch.

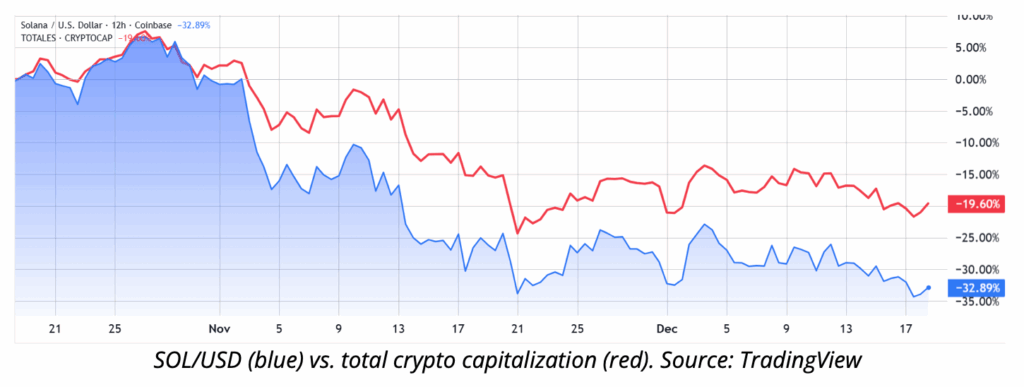

If you feel like something’s off in crypto right now, it’s understandable. Even as ETF launches, institutional buying, and pro-crypto regulators ensure all the bull market ingredients are present, the total market cap has fallen 32% from October highs.

Solana dropped on December 19th despite ecosystem momentum that should be driving prices higher, and Solana price predictions seem to be pointing the finger at leverage. In truth, the SOL long-term outlook now depends on factors nobody can control with confidence.

For traders who’d rather not struggle with Solana price prediction uncertainty, DeepSnitch AI is a great alternative with completely different exposure and far more upside potential, precisely because it remains reliable even when markets aren’t.

This presale ships live tools, so its credibility and utility are impossible to deny, with above $850,000 raised at $0.02903 per token. And the launch is approaching at full speed.

Trump eyes Fed chair, quantum fears surface

Despite ETF launches, institutional buying, and pro-crypto regulators, crypto keeps trending down. CNBC’s Ran Neuner says something is structurally broken, while 10x Research’s Markus Thielen believes winter has already arrived.

If you’re following the Solana price prediction, it makes sense that you’d be watching closely as total market cap sits 32% below October highs.

President Trump, in the meantime, has praised pro-crypto Fed nominee Chris Waller as “great” after a recent interview, with a decision expected within weeks. Waller has called crypto payments “nothing to be afraid of,” while a dovish Fed chair could reignite risk appetite and shift the Solana price forecast trajectory heading into 2026.

Meanwhile, quantum computing anxiety is weighing on Bitcoin. Castle Island’s Nic Carter called it “extremely bearish” that developers deny quantum risks while capital quietly rotates away. The perception gap drums up uncertainty affecting the SOL long-term outlook, and that’s true even without an actual threat materializing.

SOL long-term outlook and alternatives with strong offerings

- DeepSnitch AI

Market structure matters less when you’re early enough and when utility is the main event, and DeepSnitch AI sits at Stage 3 of a 15-stage presale with those boxes checked. And unlike most AI tokens promising abstract infrastructure, this one targets retail directly with tools that work today.

Among them, SnitchGPT is already deployed, offering users already on the internal platform the most vital, real-time intel powered by adaptive query parsing and multi-source data fusion. The conversational interface bridges raw blockchain data and actionable insight, so there are no technical expertise is required, and everyone can now get in on the tricks of the trade.

Internally, Token Explorer is active too, with single-token deep dives, visual risk profiling, liquidity metrics, and holder concentration data in one view. And the unified intelligence dashboard connects SnitchFeed and SnitchScan (two other agents), as well as SnitchGPT, as one cognitive layer, so they can work together to track anomalies, communicate with traders, and field queries at a moment’s notice.

Intelligence can be interrogated here, not just collected. So, you ask, explore, and act interactively, entirely evading the information overwhelm that so often plagues dashboards and raw feeds.

The Solana price forecast depends on macro factors outside your control, but DeepSnitch AI’s trajectory depends on adoption and expert-developed tools so sharp that they’ll no doubt ensure adoption on a massive scale.

With staking live, above 10 million DSNT locked, and launch imminent, the flywheel is turning. Ahead of January 1, you can use bonus codes DSNTVIP50 (50% extra above $2,000) or DSNTVIP100 (100% extra above $5,000) before they expire.

- Solana

The Solana technical trajectory points to critical support levels affecting Solana price prediction models. SOL broke below the $132 Fibonacci level, triggering algorithmic selling, and the 200-day EMA sits near $137, now acting as resistance. An RSI near 33 is a mark of oversold conditions without bullish divergence yet.

ETF delays have piled on the pressure as far as the SOL long-term outlook is concerned. At $125, SOL trades well below its highs. But Bitwise’s BSOL logged 33 straight inflow days totaling above $600 million. Data from SOL analysis shows the Solana price prediction facing structural questions.

Firedancer testnet progress supports the Solana technical trajectory long-term. But for immediate upside on Solana price prediction timelines, presales with deployed utility offer cleaner risk-reward.

- Chainlink

Oracle networks don’t get the hype memecoins do, but they’re the backbone of DeFi, and Chainlink keeps confirming that reality.

The December 18th partnership with FCA-regulated New Change FX for on-chain FX benchmarks didn’t move price much (LINK slipped above 2% as liquidity rotated toward Bitcoin), but it reinforced why institutions keep building on this infrastructure.

At $12.50, LINK trades below its 30-day moving average, and technicals look soft. But rankings tell a different story, as it’s number one across DeFi, Yield Farming, Gaming, and AI sectors.

For SOL long-term outlook diversification, LINK offers battle-tested fundamentals. But then again, its $8.7 billion market cap needs massive inflows just to double, while presales at early-stage pricing can multiply on a fraction of that capital.

That’s perhaps something to consider when mapping out the Solana price prediction alternatives you’d like to invest in ahead of 2026.

Bottom line

The Solana price prediction hinges on ETF approvals, macro sentiment, and leverage normalization. SOL and LINK offer infrastructure exposure with institutional tailwinds, while DeepSnitch AI has presale entry into deployed AI tools on the table.

Launch is coming up swiftly, and getting in now could mean seeing the major rewards that only a rare moonshot token can bring.

Check out the official website and follow X and Telegram for updates.

FAQs

What is the Solana price prediction for 2026?

According to a range of Solana price predictions, ETF approval could push SOL toward over $200, but the near-term depends on holding $117 support through macro uncertainty.

Is Chainlink still a good investment heading into 2026?

LINK’s oracle dominance ensures long-term relevance, though its large market cap limits near-term multiples.

Which AI crypto has the most potential for 2026?

DeepSnitch AI combines presale pricing, deployed tools, and live staking, all fundamentals supporting asymmetric upside before launch.