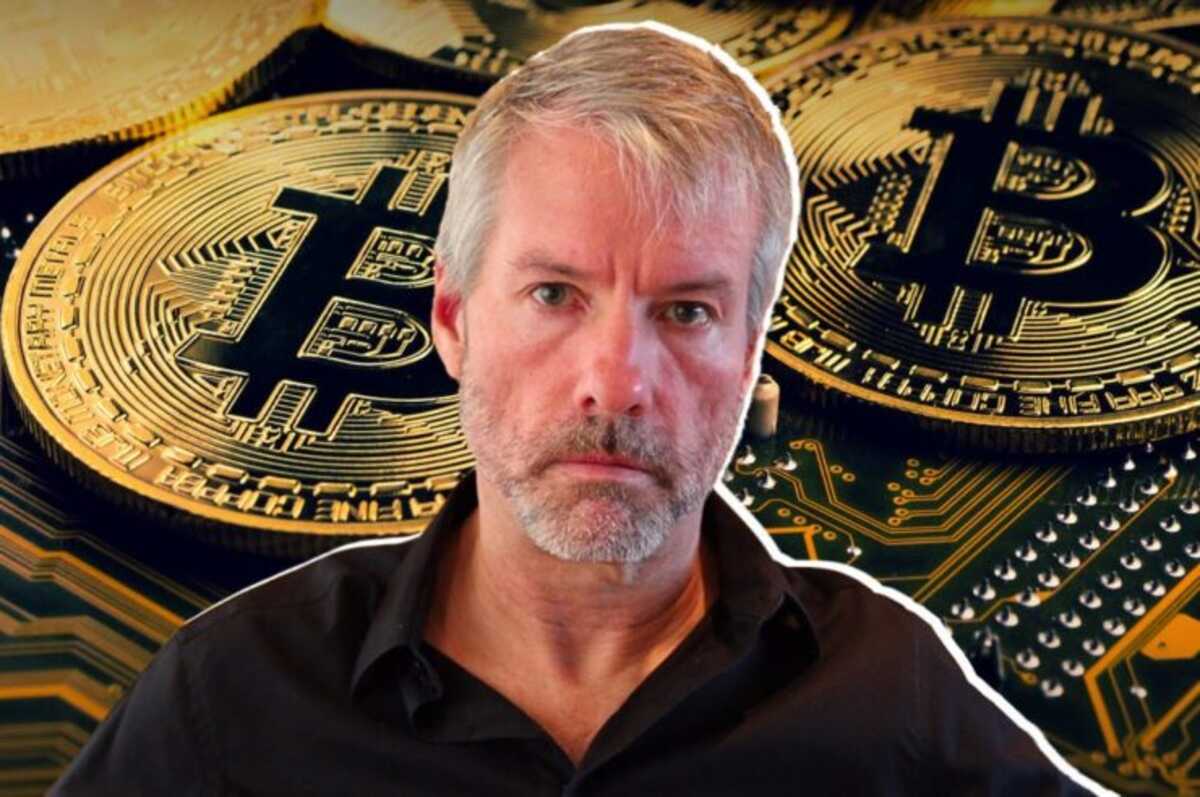

Michael Saylor Proposes $81T Strategic Bitcoin Plan for the USA

Michael Saylor unveils a framework for the U.S. to earn $81 trillion by adopting a Strategic Bitcoin Reserve. Here's how it works.

- Michael Saylor advocates for a U.S. Strategic Bitcoin Reserve to boost the economy.

- The proposed framework suggests potential earnings of $81 trillion.

- The plan aims to position the U.S. as a global Bitcoin leader.

Michael Saylor’s $81 Trillion Bitcoin Proposal

Bitcoin evangelist Michael Saylor has unveiled an ambitious framework for the United States to generate a staggering $81 trillion by establishing a Strategic Bitcoin Reserve. Saylor, known for his unwavering advocacy of Bitcoin, believes this plan could transform the U.S. economy and solidify its leadership in the digital asset space.

The Vision: Strategic Bitcoin Reserve

The core of Saylor’s proposal is for the U.S. government to acquire and hold Bitcoin as a strategic reserve asset. By leveraging Bitcoin’s potential as a deflationary and appreciating store of value, he argues that the reserve could provide unmatched economic benefits. Over time, this strategy could yield $81 trillion, considering Bitcoin’s finite supply and its growing adoption worldwide.

According to Saylor, embracing Bitcoin would:

- Stabilize the U.S. dollar by backing it with a robust digital asset.

- Attract global investment and innovation in blockchain technology.

- Provide a hedge against inflation and declining fiat value.

Why Now?

Saylor emphasizes that time is of the essence. As more countries begin exploring Bitcoin adoption, early movers stand to gain the most. The framework also highlights how Bitcoin can enhance national security by reducing reliance on foreign reserves and mitigating the risks associated with fluctuating fiat currencies.

Can the U.S. Lead the Bitcoin Revolution?

While Saylor’s proposal is ambitious, it faces significant hurdles, including regulatory challenges, political opposition, and public skepticism. However, with growing institutional adoption of Bitcoin, his vision aligns with an emerging trend of governments recognizing the strategic value of digital assets.

Final Thoughts

Saylor’s $81 trillion framework is not just a financial proposition but a call to action for the U.S. to take the lead in the digital age. Whether the government will adopt this bold strategy remains to be seen, but it certainly ignites a compelling conversation about Bitcoin’s role in the future of global economics.