LATAM Crypto Volume Hits $27B, Fueled by Stablecoins

Crypto exchange volume in LATAM soared to $27B, driven by stablecoins and top chains like Ethereum, Tron, Solana, and Polygon.

- LATAM exchange volume grew 9x to $27B from 2021 to 2024

- USDT and USDC made up over 90% of July 2025 trading volume

- BRL and MXN-pegged stablecoins saw explosive YoY growth

The crypto market in Latin America (LATAM) is booming. According to Dune’s latest report, the region’s exchange volume skyrocketed from just a few billion dollars in 2021 to $27 billion by 2024—a massive 9x increase. This surge is mainly powered by the growing use of stablecoins and popular blockchain networks.

Ethereum, Tron, Solana, and Polygon are the key players behind this growth, offering fast, low-cost transactions and strong infrastructure that supports both retail and institutional users. These blockchains serve as the backbone for many stablecoin transactions in the region, particularly for USDT and USDC.

Stablecoins Dominate Trading Volume

In July 2025 alone, over 90% of LATAM’s crypto trading volume came from stablecoins, with Tether (USDT) and USD Coin (USDC) leading the charge. This reflects a strong demand for dollar-linked assets in economies dealing with inflation and currency volatility.

Beyond the USD stablecoins, local currencies are starting to gain traction in the form of digital tokens. BRL-pegged stablecoins (tied to the Brazilian Real) saw a 660% year-over-year increase, while MXN-pegged tokens (based on the Mexican Peso) exploded with a jaw-dropping 1,100x growth.

Why Local Stablecoins Matter

The rise of BRL and MXN stablecoins highlights a growing interest in using crypto for real-world payments and remittances within national borders. For countries like Brazil and Mexico, this signals a new phase of adoption where local stablecoins can complement or even replace traditional financial tools.

Crypto adoption in LATAM is no longer just about speculation—it’s about solving real financial challenges. With continued innovation in stablecoins and blockchain scalability, the region is on track to become a global leader in crypto utility.

Read Also :

- CME Launches Cardano, Chainlink & Stellar Futures

- BlockDAG Miner Sales End, Pushing Buyers to Snap Up the Remaining BDAG Coins for 1,566% ROI! ADA & XRP Lose Momentum

- Bitmine Staked 154K ETH, Total Now at 1.68M ETH

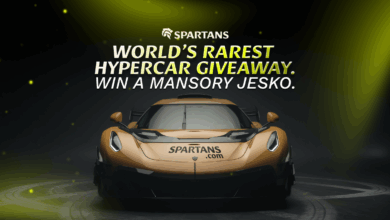

- Spartans.com Redefines Rewards: One-of-One Mansory Jesko Giveaway Goes Live

- Bitmine Invests $200M in MrBeast’s Beast Industries