Bitcoin Breakout Above $96K Suggests Potential Rally Towards $120K Amid Strong Buying Activity

-

Bitcoin’s recent surge past the pivotal $96K resistance has positioned it towards a potential rally targeting $120K, indicating robust bullish strength.

-

With active addresses on the rise and reduced exchange reserves, the market sentiment surrounding Bitcoin appears increasingly optimistic.

-

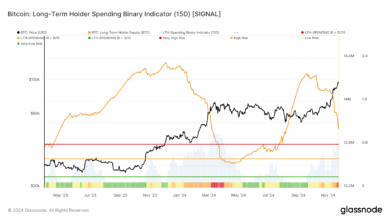

According to insights from COINOTAG, “The influx of long-term holders is a key factor contributing to the current upward momentum.”

Bitcoin’s breakout signals bullish momentum with a potential rise to $120K, supported by increased network activity and reduced exchange supply.

‘,

‘<p><strong>🚀 Advanced Trading Tools Await You!Maximize your potential. Join now and start trading!</strong></p>‘,

‘<p><strong>📈 Professional Trading PlatformLeverage advanced tools and a wide range of coins to boost your investments. Sign up now!</strong></p>‘

];

var adplace = document.getElementById(“ads-bitget”);

if (adplace) {

var sessperindex = parseInt(sessionStorage.getItem(“adsindexBitget”));

var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesBitget.length) : sessperindex;

adplace.innerHTML = adscodesBitget[adsindex];

sessperindex = adsindex === adscodesBitget.length – 1 ? 0 : adsindex + 1;

sessionStorage.setItem(“adsindexBitget”, sessperindex);

}

})();

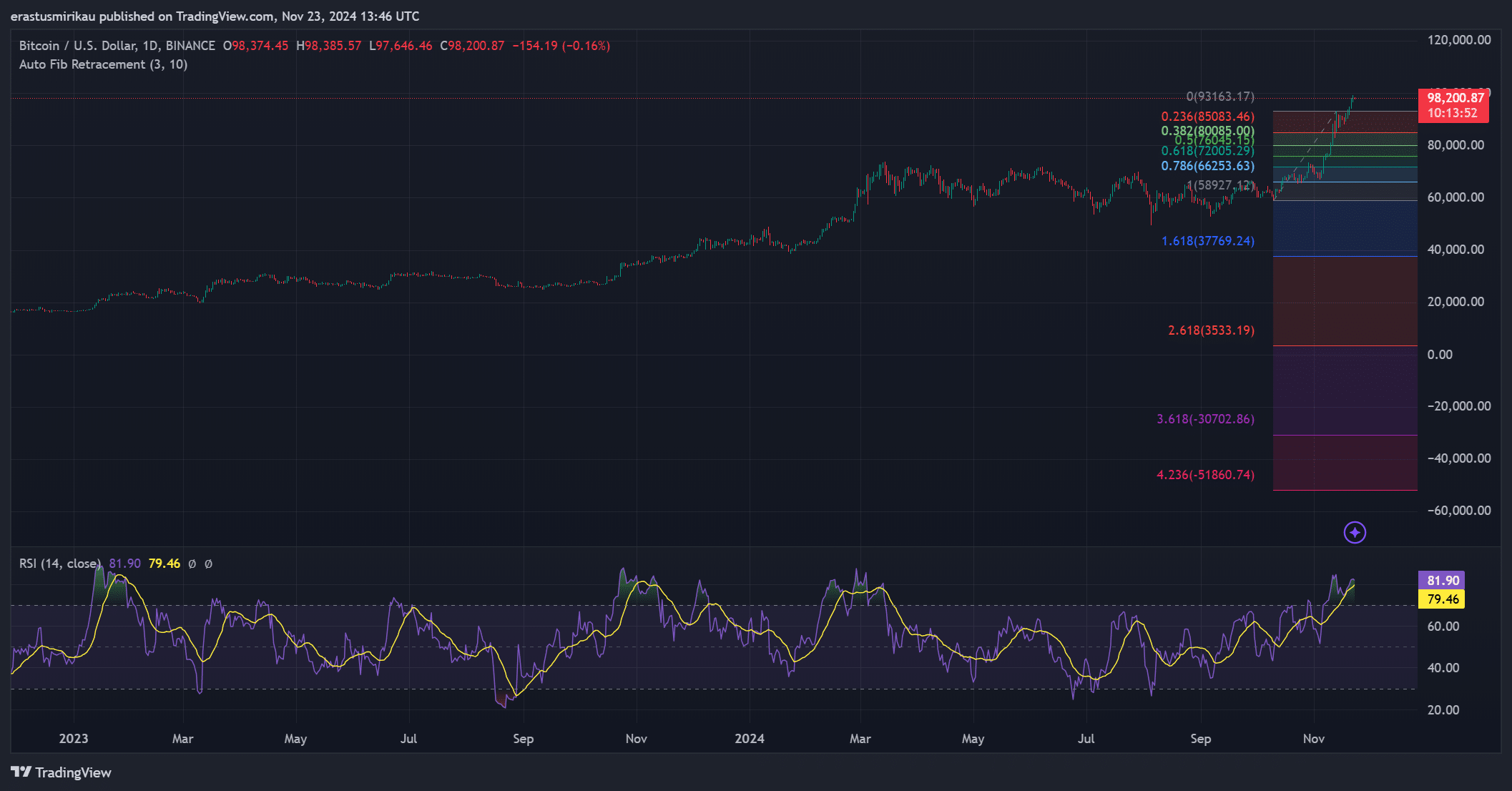

Technical indicators reflect strong bullish momentum

The surge in Bitcoin’s price is supported by favorable technical indicators, marking a significant bullish trend in the market. The Relative Strength Index (RSI) currently sits at 79, suggesting strong buying activity while nearing overbought territory. Fibonacci retracement levels also affirm that Bitcoin is securely above the crucial 0.786 level at $85K, which shows its upward streak is robust.

The next Fibonacci extension suggests a potential price target of $120K if the $96K resistance acts as strong support. However, vigilance is prudent; a drop below this benchmark could trigger bearish reactions.

‘,

‘<p><strong>🔒 Secure and Fast TransactionsDiversify your investments with a wide range of coins. Join now!</strong></p>‘,

‘<p><strong>💎 The Easiest Way to Invest in CryptoDont wait to get started. Click now and discover the advantages!</strong></p>‘

];

var adplace = document.getElementById(“ads-binance”);

if (adplace) {

var sessperindex = parseInt(sessionStorage.getItem(“adsindexBinance”));

var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesBinance.length) : sessperindex;

adplace.innerHTML = adscodesBinance[adsindex];

sessperindex = adsindex === adscodesBinance.length – 1 ? 0 : adsindex + 1;

sessionStorage.setItem(“adsindexBinance”, sessperindex);

}

})();

Thus, maintaining support above $96K is critical to sustaining the bullish trend, while a slip below this level might lead to necessary market corrections.

‘,

‘<p><strong>🔥 The Power of the TRON Ecosystem is Yours!Click now to discover exclusive opportunities!</strong></p>‘,

‘<p><strong>💎 Profit Opportunities on the TRON NetworkJoin now to strengthen your investments!</strong></p>‘

];

var adplace = document.getElementById(“ads-htx”);

if (adplace) {

var sessperindex = parseInt(sessionStorage.getItem(“adsindexHtx”));

var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesHtx.length) : sessperindex;

adplace.innerHTML = adscodesHtx[adsindex];

sessperindex = adsindex === adscodesHtx.length – 1 ? 0 : adsindex + 1;

sessionStorage.setItem(“adsindexHtx”, sessperindex);

}

})();

Source: TradingView

Increased buying activity enhances BTC outlook

Recent trading data indicates a noticeable increase in buying pressure across major exchanges, highlighted by a Taker Buy/Sell Ratio of 1.03. This ratio signifies a trend where buyers consistently outweigh sellers, which buttresses Bitcoin’s ascent above $96K.

Exchanges such as Binance, OKX, and Bybit have reported heightened trading volumes, illustrating an inflow from both institutional and retail investors, which significantly enhances the cryptocurrency’s bullish prospects.

As a result, this influx of market activity anticipates Bitcoin’s continued rise, targeting the landmark figure of $120K.

Source: CryptoQuant

Declining exchange reserves support bullish sentiment

Simultaneously, Bitcoin’s exchange reserves have decreased by 0.29% over the past 24 hours, currently resting at 2.509 million BTC. This decline signifies that more Bitcoin is being withdrawn to cold wallets, an indication of increasing long-term holder confidence and diminishment of immediate selling pressure.

A persistent reduction in exchange reserves often correlates with tightening supply, which can further enhance upward price dynamics, propelling Bitcoin towards its targets.

Source: CryptoQuant

Increasing network activity reinforces bullish outlook

Additionally, Bitcoin’s network activity has shown promising signs, with Active Addresses increasing by 1% to reach 10.703K over the last 24 hours, signifying a growing engagement among users.

The number of transactions also rose by 0.79%, totaling 540K, which highlights an uptick in Bitcoin’s utility and reinforces the bullish sentiment surrounding the cryptocurrency.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s breakout above $96K marks a critical juncture in the market. With strong technical and on-chain metrics supporting this rally, a move towards $120K seems imminent. Therefore, as long as Bitcoin maintains its footing above the critical $96K support, the bullish trajectory is highly likely to persist.

Conclusion

In summary, Bitcoin’s recent price action exemplifies solid bullish strength, underpinned by favorable technical indicators and a healthy market sentiment. The journey towards $120K appears achievable if the support at $96K holds firm, providing an optimistic outlook for investors and market participants alike.

Don’t forget to enable notifications for our <strong>Twitter</strong> account and <strong>Telegram</strong> channel to stay informed about the latest cryptocurrency news.