Why Altcoin Seasons Are Fading Away

Altcoins have underperformed Bitcoin for 4 years. Is the era of altcoin seasons coming to an end?

- Altcoins have lagged behind Bitcoin for four years.

- Traditional altcoin season cycles may be breaking down.

- Investors shift focus to Bitcoin dominance and long-term trends.

For over a decade, the crypto market has followed a fairly predictable pattern. Every four years, Bitcoin would lead a bull run, and shortly after, altcoins would surge — a phenomenon often dubbed the “altcoin season.” But recent trends suggest this cycle may be breaking down.

For the last four years, altcoins have consistently underperformed Bitcoin. This persistent downtrend has cast doubt on whether the classic altcoin season will return at all. The widening performance gap is causing investors and analysts to reassess expectations moving forward.

Bitcoin Dominance Continues to Rise

Bitcoin’s dominance — the metric that measures its share of the total crypto market capitalization — has steadily increased. This trend shows that more capital is flowing into Bitcoin compared to altcoins. The reasons are clear: institutional interest, Bitcoin ETFs, and a growing view of BTC as “digital gold” are drawing more attention and money to the leading cryptocurrency.

As a result, altcoins are losing their momentum. While some projects still offer strong fundamentals and innovative use cases, they are no longer enjoying the explosive growth seen in past cycles.

Is the Altcoin Season Dead?

Many crypto enthusiasts are now asking: is the altcoin season dead? While it’s too early to say definitively, the signs suggest a major shift is underway. Instead of a synchronized altcoin boom, we may now see isolated runs by individual tokens — based more on utility, partnerships, or real-world adoption than on speculative hype.

This shift marks a maturing phase in the crypto industry. Investors may need to rethink their strategies and stop relying on past cycles to predict future movements. The days of betting on a massive altcoin rally after every Bitcoin surge may be over — replaced by a more selective and data-driven approach.

Read Also :

- Bitmine Publishes New Chairman’s Message Explaining Why Shareholders Should Vote YES to Approve the Amendment to Increase Authorized Shares

- Solana and Ethereum Stay Cautious as BlockDAG’s Final 3.5B Coins Shift Market Focus

- Why ZKP Is Becoming a Favorite Among Smart Crypto Investors, While Hyperliquid and Chainlink Fall Behind!

- Dogecoin price prediction for 2026: DeepSnitch AI Presale Moves Past $1M as the Reserve Bank of India Urges Countries to Focus on CBDCs Over Stablecoins

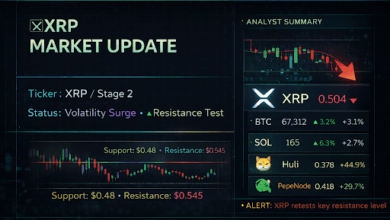

- XRP Price Prediction by 2030: $200M in Dormant Crypto Exposes Retail Fatigue as DeepSnitch AI Shatters $1 Million Milestone